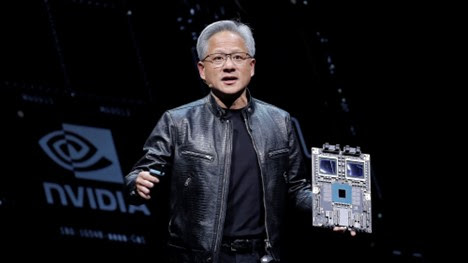

Nvidia's strategic focus on artificial intelligence and data center markets, coupled with its groundbreaking A100 Tensor Core GPU, has catapulted the company to unprecedented heights, making it the world's most valuable company with a market capitalization of $3.3 trillion.

On June 18, 2024, Nvidia Corporation achieved a milestone that sent ripples through the global financial markets. The company overtook Microsoft to become the world's most valuable company, boasting a staggering market capitalization of $3.3 trillion. This astronomical figure is over 20 times what Nvidia's valuation was in January 2020, marking a meteoric rise fueled by an insatiable demand for its artificial intelligence (AI) chips from technology giants worldwide. As investors scramble to acquire Nvidia shares, its financial performance underscores the extraordinary growth trajectory of the company.

Nvidia's

revenue for the quarter ending in April surged by 262% year-on-year, reaching

unprecedented heights. The company reported a net income increase of 628% for

the same period, reflecting its robust financial health and operational

efficiency. This dramatic financial upswing can be attributed to the burgeoning

demand for AI technology, which has become integral to various sectors,

including cloud computing, autonomous vehicles, and advanced robotics.

The

rise of Nvidia as the world's most valuable company is a testament to the

transformative power of AI technology. Nvidia's graphics processing units

(GPUs) have become the gold standard for AI applications, powering everything

from sophisticated machine learning models to complex data analytics. The

company's GPUs are designed to handle the massive computational workloads

required for AI and deep learning, making them indispensable to tech giants

like Amazon, Google, and Microsoft, who are heavily investing in AI to drive

innovation and efficiency.

One

of the pivotal factors behind Nvidia's success is its strategic focus on AI and

data center markets. Nvidia's A100 Tensor Core GPU, launched in 2020, has been

a game-changer, offering unprecedented performance for AI training and

inference. The A100's architecture is designed to accelerate diverse workloads,

from deep learning and high-performance computing (HPC) to data analytics and

graphics. This versatility has made it a preferred choice for leading cloud

service providers and research institutions.

Furthermore,

Nvidia's acquisition of ARM Holdings for $40 billion in 2020 significantly

bolstered its capabilities and market position. ARM's technology is ubiquitous

in mobile devices, and its integration with Nvidia's GPU technology has opened

new avenues for innovation in AI and edge computing. This acquisition has

enabled Nvidia to expand its reach into new markets and enhance its product

offerings, reinforcing its leadership in the AI chip industry.

The

impact of Nvidia's AI chips extends beyond traditional technology sectors. In

the automotive industry, Nvidia's DRIVE platform is revolutionizing autonomous

driving by providing the computational power needed for real-time processing of

sensor data and decision-making algorithms. Companies like Tesla and

Mercedes-Benz are leveraging Nvidia's technology to develop self-driving cars,

which promise to redefine transportation and mobility.

Nvidia's

dominance in the AI chip market has not gone unnoticed by its competitors.

Companies like Intel and AMD are ramping up their efforts to capture a share of

the lucrative AI market. Intel's acquisition of Habana Labs, an AI chipmaker,

and its development of the Nervana Neural Network Processor (NNP) are strategic

moves aimed at challenging Nvidia's supremacy. Similarly, AMD's advancements in

AI and data center GPUs reflect the intensifying competition in the industry.

Despite

the fierce competition, Nvidia's continuous innovation and strategic

acquisitions have solidified its position at the forefront of the AI

revolution. The company's commitment to research and development (R&D) is

evident from its substantial investments in cutting-edge technologies. In 2023,

Nvidia's R&D expenditure reached $6.9 billion, underscoring its dedication

to maintaining its technological edge and driving future growth.

The

regulatory landscape also plays a crucial role in shaping the competitive

dynamics of the AI chip market. In 2022, the U.S. government introduced the

CHIPS and Science Act, which aims to bolster domestic semiconductor

manufacturing and reduce dependence on foreign supply chains. The legislation

provides substantial funding and incentives for companies to invest in

semiconductor R&D and production within the United States. Nvidia, with its

strong U.S. presence, stands to benefit from these initiatives, further

enhancing its competitive position.

Nvidia's

rise to the top of the market capitalization charts reflects broader trends in

the technology sector. The COVID-19 pandemic accelerated digital transformation

across industries, driving demand for cloud computing, e-commerce, and remote

work solutions. As a result, companies with strong AI and data center

capabilities, like Nvidia, experienced exponential growth. This shift towards

digitalization is expected to continue, sustaining the demand for AI chips and

related technologies.

The

financial markets have responded enthusiastically to Nvidia's remarkable

performance. The company's stock price has seen a substantial uptick,

attracting both institutional and retail investors. Analysts remain bullish on

Nvidia's prospects, projecting continued growth driven by the expanding AI

market and the company's leadership in GPU technology.

However,

Nvidia's journey to becoming the world's most valuable company is not without

challenges. The global semiconductor shortage, which began in 2020, has posed

significant supply chain constraints for chip manufacturers. Nvidia, like its

peers, has had to navigate these disruptions, balancing supply and demand to

meet the needs of its customers. Additionally, geopolitical tensions and trade

policies could impact the global semiconductor industry, influencing Nvidia's

operations and market dynamics.

In

plain terms, Nvidia's ascension as the world's most valuable company

underscores the transformative impact of AI technology on the global economy.

The company's innovative AI chips have become indispensable to tech giants and

various industries, driving its extraordinary financial performance and market

valuation. As Nvidia continues to push the boundaries of AI and semiconductor

technology, it remains at the forefront of the digital revolution, shaping the

future of technology and industry.

No comments:

Post a Comment